5 Reasons Companies Choose NetSuite After QuickBooks

5 Reasons Companies Choose NetSuite After QuickBooks

QuickBooks is very often the first place a startup company looks for an accounting system to run its operations. The system is affordable, easy to get up and running and fairly easy to use. However, as companies grow, explore new lines of business and expand their global horizons, the basic accounting platform usually has to be replaced with a more robust software solution.

When companies reach this stage, BDO Digital recommends NetSuite as the next logical step. NetSuite is a platform that companies will never “outgrow” and that’s used by small companies all the way up to global enterprises with multiple currencies and many subsidiaries—and all stages in between.

See How BDO Digital and NetSuite Help

C-Suite Executives Get a Good Night’s Rest

"If you’re running a very small business with just a few people and no major growth aspirations, then QuickBooks may suit your needs. However, when you reach a certain point, QuickBooks becomes a liability because you’ll have no approvals, controls or audit capabilities."

Here are five reasons why companies choose NetSuite after using QuickBooks:

The need to quickly gear up for growth. If your organization is in growth mode, heading toward profitability, opening new locations, expanding overseas or hiring more team members, you’ve probably been wondering whether your current accounting platform will be able to handle this growth. With this in mind, you’ve been considering a switch to a more robust solution and NetSuite is likely at or near the top of your list.

See How a Biopharmaceutical Company Sped Towards Commercialization with NetSuite

Their current system is bogged down. Slow software running times and frequent crashes are common occurrences for companies that are outgrowing their basic software platforms. NetSuite is a robust, cloud-based business management platform that runs at optimal performance.

Accountants are using too many workarounds. Accountants that use QuickBooks will often create workarounds to make the basic system function for their organizations. Then, Excel spreadsheets are used to manually calculate accruals, amortization and depreciation. This not only increases the likelihood of data errors, but it also wastes time that could be put to better use on more important financial projects. With NetSuite, accountants have everything they need in a single system, with no need for any manual workarounds.

The books take too long to close. If your company is still using manual data entry processes, it’s a problem taking too many days (or even weeks) to close the books every month. When your accounting team has to consolidate data from multiple sources to generate accurate financial statements, it holds up the month- end close process. NetSuite alleviates these issues by providing the automation and workflows needed to get the books closed on time, every time.

And finally, you’re plagued by too many data errors. Errors can happen anytime someone searches for data and then has to manually input that information into yet another system. These errors translate into inaccurate financial statements, poor decision-making and other challenges. Data errors also create challenges when they come during audits, when auditors are actively looking for any discrepancies in your organization’s financial records. NetSuite provides the data validation, integrity checks, audit trail and real-time reporting that you need to significantly improve data quality.

These are just some of the core challenges companies start to face as they outgrow their basic accounting systems. If you’re feeling any or all of these common pain points, BDO Digital will help you get the most out of NetSuite with its vast global network of industry and technology professionals. Achieve growth, scale and agility while uncovering efficiencies in your business that will help you maximize both the top and bottom line.

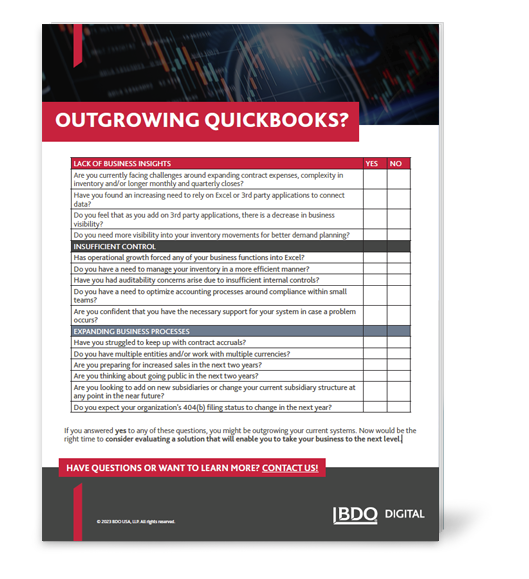

Download our Checklist to see if you've outgrown QuickBooks.

Use this checklist to see if now could be the right time to consider a new solution that will enable you to take your business to the next level.

Related Resources

Adobe Summit 2024: Unleashing Operational Excellence with New Innovations

April 17, 2024Adobe Summit 2024: Unleashing Operational Excellence with New Innovations

April 17, 2024See what four key insights and breakthroughs were presented at Adobe Summit 2024 and how they intend to redefine the landscape of operational efficiency.

How to Upgrade Data Security Before Adding AI: Five Steps

April 15, 2024How to Upgrade Data Security Before Adding AI: Five Steps

April 15, 2024While these new artificial intelligence tools are helpful for generating approaches and content based on natural language queries, they also pose potential risks of exposing sensitive data or violating compliance regulations.

Everything To Know About Microsoft Security Copilot

April 3, 2024Everything To Know About Microsoft Security Copilot

April 3, 2024Microsoft made their Copilot for Security tool generally available on April 1, 2024. With its advancements in speed and scalability, this generative AI-powered cybersecurity assistant is poised to revolutionize cybersecurity.

Revamping Ecommerce: Enhancing Security and User Experience for Future Growth

March 12, 2024Revamping Ecommerce: Enhancing Security and User Experience for Future Growth

March 12, 2024Discover the ways BDO helped a company upgrade its Magento e-commerce platform to the newest version while migrating host data to a more secure, scalable location.

SHARE